2024 Form 1040 Qualified Business Deduction Worksheet

2024 Form 1040 Qualified Business Deduction Worksheet – The standard deduction reduces the amount of your taxable income—the IRS has increased it in 2023 and 2024, which could result in a lower tax bill for many Americans. . However, you won’t know for sure unless you use IRS form 1040 Deduction? Similar to the regular net operating loss deduction, the alternative tax net operating loss deduction lets business .

2024 Form 1040 Qualified Business Deduction Worksheet

Source : www.irs.govEmployee’s Withholding Certificate

Source : www.irs.gov1040 (2023) | Internal Revenue Service

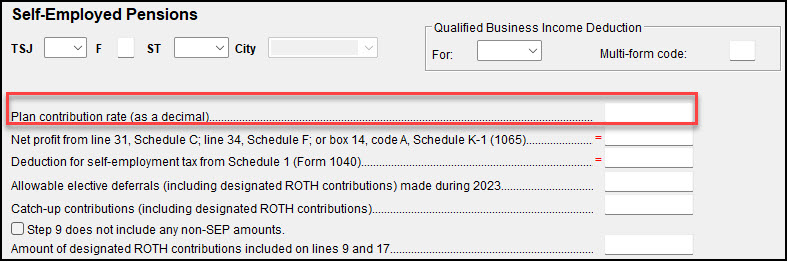

Source : www.irs.gov1040 Generating the SEP Worksheet

Source : drakesoftware.com1040 (2023) | Internal Revenue Service

Source : www.irs.govReal Estate Agent Tax Deductions Worksheet Pdf Fill Online

Source : real-estate-agent-tax-deductions.pdffiller.com1040 (2023) | Internal Revenue Service

Source : www.irs.govNurse Tax Deduction Worksheet Fill Online, Printable, Fillable

Source : nurse-tax-deduction-worksheet.pdffiller.com1040 (2023) | Internal Revenue Service

Source : www.irs.govFree Paycheck and Salary Calculator: Calculate Take Home Pay

Source : factorialhr.com2024 Form 1040 Qualified Business Deduction Worksheet Publication 505 (2023), Tax Withholding and Estimated Tax : However, regardless of successes or failures, most small businesses are required to report their profit and loss deductions a profit or loss. The 1040 or 1040A Form Business owners must . and attached to your Form 1040. The deduction extends to cover your child under 27 years of age, regardless of dependency status. Broadly speaking, business deductions require you to itemize .

]]>